Introduction: UK house prices stagnated in November, weak retail spending too

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

As the first week of December draws to a close, we have fresh evidence that the economy cooled in the run-up to last month’s budget.

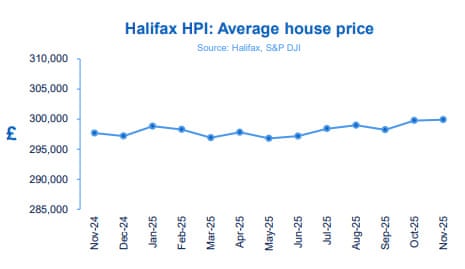

UK house prices were broadly unchanged in November, lender Halifax reports, with that average property changing hands for £299,892. That stagnation follows a 0.5% rise in October, and makes houses slightly more affordable to new buyers.

On an annual basis, prices were 0.7% higher – down from +1.9% house price inflation in October.

Amanda Bryden, head of mortgages at Halifax, explains:

“This consistency in average prices reflects what has been one of the most stable years for the housing market over the last decade. Even with the changes to Stamp Duty back in spring and some uncertainty ahead of the Autumn Budget, property values have remained steady.

While slower growth may disappoint some existing homeowners, it’s welcome news for first-time buyers. Comparing property prices to average incomes, affordability is now at its strongest since late 2015. Taking into account today’s higher interest rates, mortgage costs as a share of income are at their lowest level in around three years.

Shoppers also reined in their spending in the shops last month.

A survey by business advisory service BDO has found that in-store sales grew by just +1.3% in November, despite the potential sales boost from Black Friday.

That is well below the rate of inflation which means that sales volumes are significantly down, BDO says.

The agenda

-

7am GMT: Halifax house price index for November

-

7am GMT: German factory orders data for October

-

8.30am GMT: UN food commodities price index

-

3pm GMT: US PCE data (Fed’s preferred inflation measure)

-

3pm GMT: University of Michigan consumer confidence report

Key events

House prices predicted to rise in 2026, after budget uncertainty

Halifax’s Amanda Bryden reckons UK house prices will rise “gradually” next year, saying:

“Looking ahead, with market activity steady and expectations of further interest rate reductions to come, we anticipate property prices will continue to grow gradually into 2026.”

Karen Noye, mortgage expert at Quilter, says affordability remains the biggest hurdle, even though inflation has eased and another interest rate cut is expected later this month, adding:

The outlook for 2026 rests on the path of mortgage rates and the resilience of household incomes. Greater clarity post budget and the prospect of lower borrowing costs give the market a firmer footing, but affordability will remain the defining constraint.”

Tom Bill, head of UK residential research at Knight Frank, blames pre-Budget uncertainty pushed house price growth close to zero, adding:

Clarity has now returned, but an array of tax rises, which include an income tax threshold freeze, will increasingly squeeze demand and prices. Offsetting that is the fact that mortgage rates are expected to drift lower next year as the base rate bottoms out at around 3.25%.”

Technically, UK house prices did rise slightly last month. On Halifax’s data, the average price was £299,892, marginally up from £299,754 in October. That’s a new record high on this index.

Halifax: a clear North/South divide on house price changes

Halifax’s regional data continues to show a clear North/South divide – prices fell in the south of the UK last month, but were stronger elsewhere.

-

Northern Ireland remains the strongest performing nation or region in the UK, with average property prices rising by +8.9% over the past year (up from +7.9% last month). The typical home now costs £220,716.

-

Scotland recorded annual price growth of +3.7% in November, up to an average of £216,781. In Wales property values rose +1.9% year-on-year to £229,430.

-

In England, the North West recorded the highest annual growth rate, with property prices rising by +3.2% to £245,070, followed by the North East with growth of +2.9% to £180,939. Further south, three regions saw prices decrease in November.

-

In London prices fell by -1.0%, the South East by -0.3% and Eastern England by -0.1%. The capital remains the most expensive part of the UK, with an average property now costing £539,766.

Introduction: UK house prices stagnated in November, weak retail spending too

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

As the first week of December draws to a close, we have fresh evidence that the economy cooled in the run-up to last month’s budget.

UK house prices were broadly unchanged in November, lender Halifax reports, with that average property changing hands for £299,892. That stagnation follows a 0.5% rise in October, and makes houses slightly more affordable to new buyers.

On an annual basis, prices were 0.7% higher – down from +1.9% house price inflation in October.

Amanda Bryden, head of mortgages at Halifax, explains:

“This consistency in average prices reflects what has been one of the most stable years for the housing market over the last decade. Even with the changes to Stamp Duty back in spring and some uncertainty ahead of the Autumn Budget, property values have remained steady.

While slower growth may disappoint some existing homeowners, it’s welcome news for first-time buyers. Comparing property prices to average incomes, affordability is now at its strongest since late 2015. Taking into account today’s higher interest rates, mortgage costs as a share of income are at their lowest level in around three years.

Shoppers also reined in their spending in the shops last month.

A survey by business advisory service BDO has found that in-store sales grew by just +1.3% in November, despite the potential sales boost from Black Friday.

That is well below the rate of inflation which means that sales volumes are significantly down, BDO says.

The agenda

-

7am GMT: Halifax house price index for November

-

7am GMT: German factory orders data for October

-

8.30am GMT: UN food commodities price index

-

3pm GMT: US PCE data (Fed’s preferred inflation measure)

-

3pm GMT: University of Michigan consumer confidence report

#house #prices #stagnated #November #south #lags #north #business #live #Business